Governance

Governance Highlights

Stratus is committed to strong and effective governance practices that are responsive to our stockholders. Our commitment to good corporate governance, including best practices that are part of our executive compensation program, is illustrated by the following practices:

Board Independence and Composition (as of December 15, 2022)

|

Key Responsibilities, Policies and Guidelines

|

Board Performance and Shareholder Rights

|

Executive Compensation

|

Board Composition and Diversity Highlights

We are committed to Board diversity and Board refreshment, and we believe the Company's policies and practices help to ensure a diversity of skills, experience, and tenure on the Board. In the past two years, we have added three new, diverse independent directors to our seven-member Board: Neville L. Rhone, Jr., Kate B. Henriksen and Laurie L. Dotter. For more information regarding our directors and diversity, see our website under the headings Company - Bios and People - Director and Executive Officer Gender and Race/Ethnic Diversity and Independence.

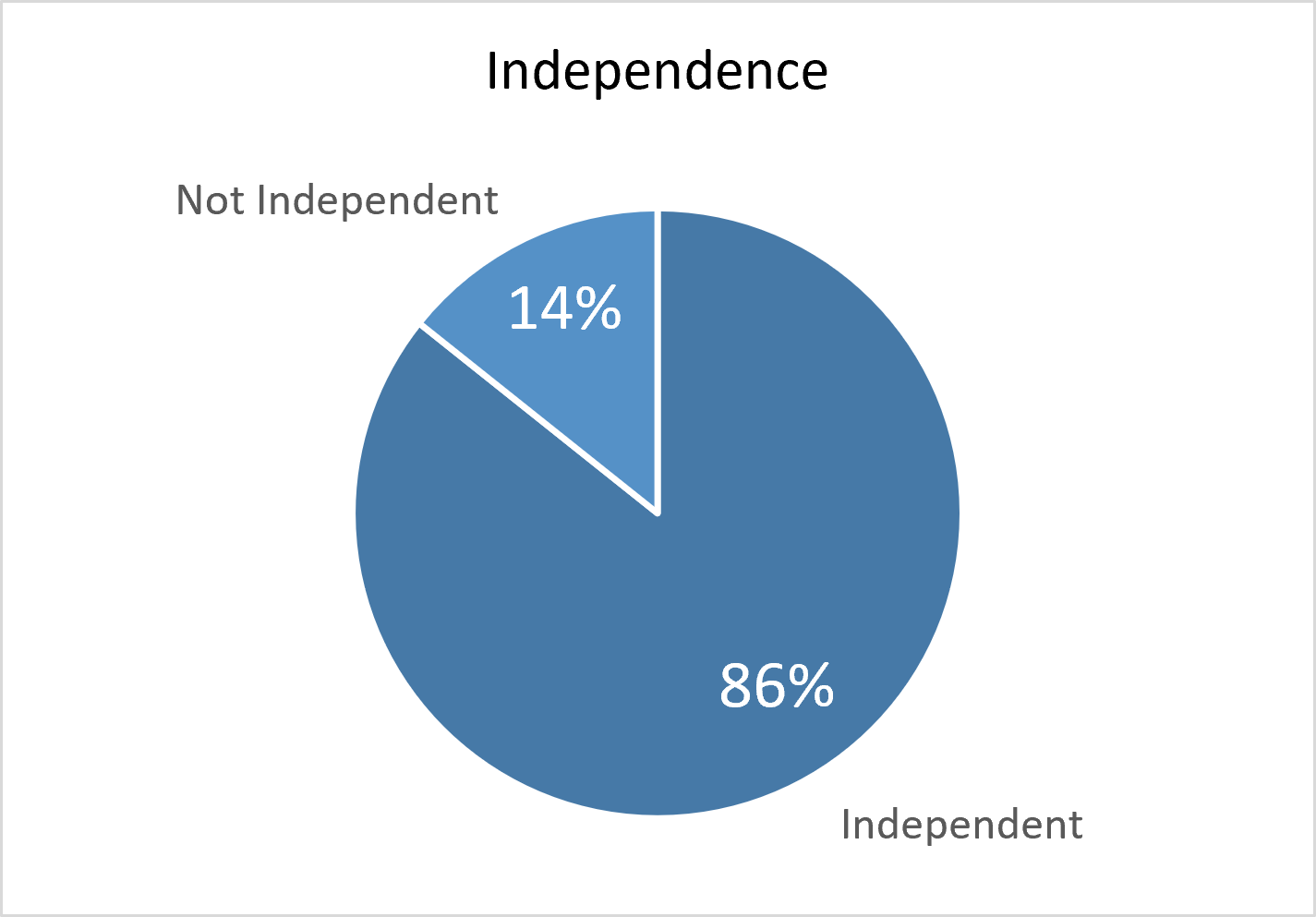

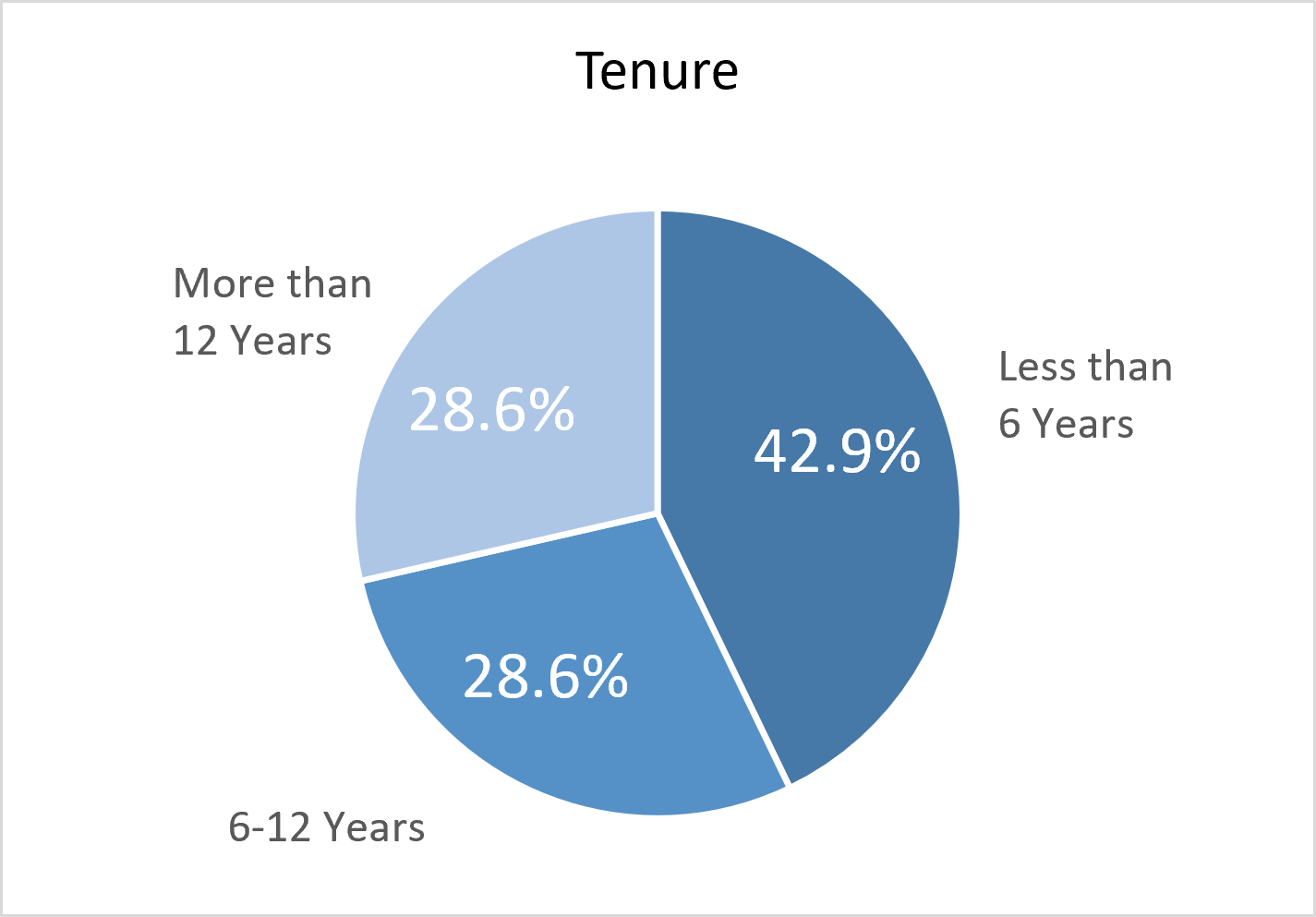

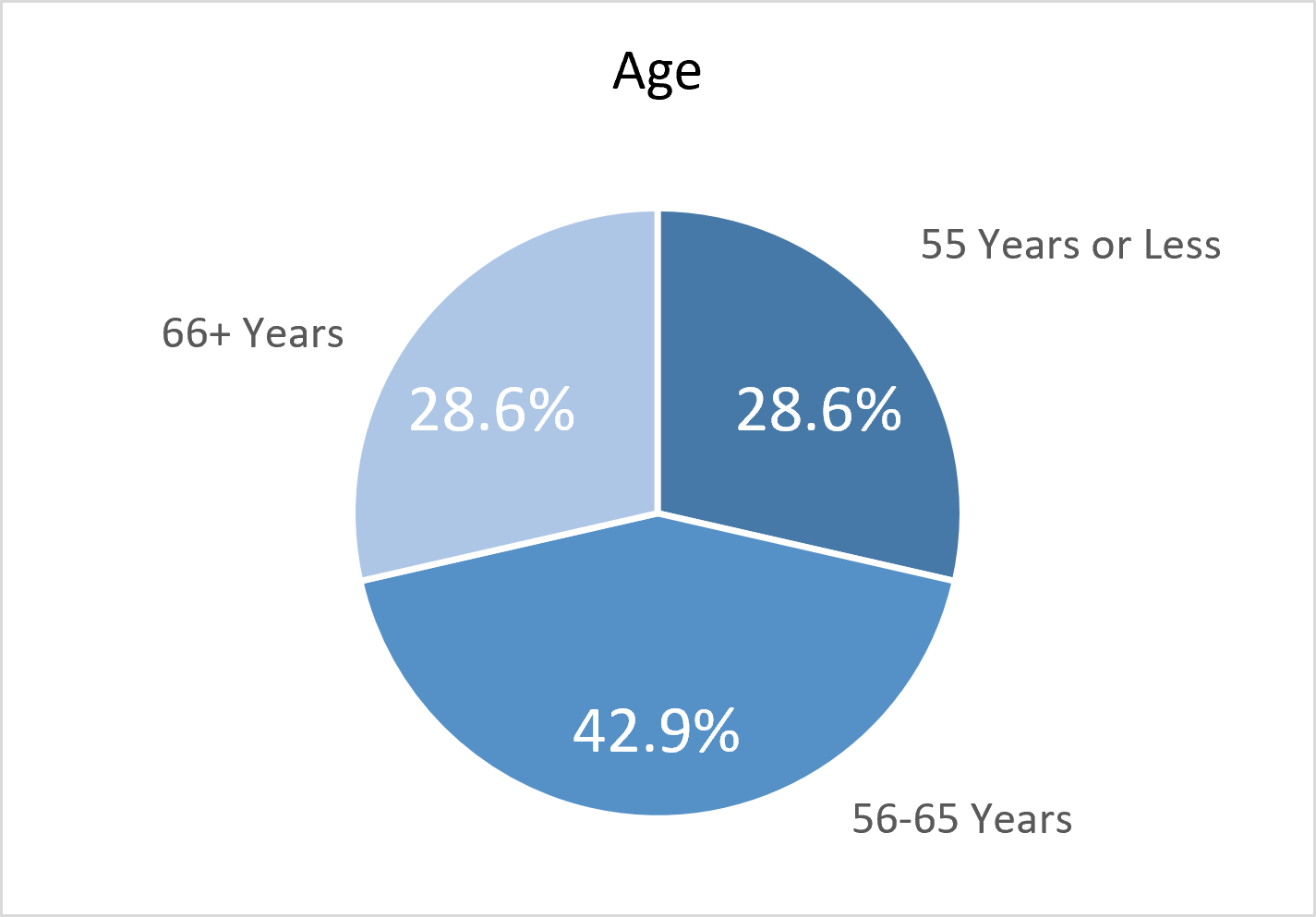

We also aim to have a Board that is independent and made up of directors with a range of tenures and ages, as illustrated below (as of December 15, 2022):

Board Skills, Experience and Background

Our directors have a diverse mix of skills, experiences and backgrounds that qualify them for service on our Board and that contribute to our ability to create value for our stockholders. The table below is intended to highlight each director's particular strengths, and an individual director may have other skills, experiences and personal attributes not highlighted in the table.

| Skills and Experience | Dotter | Henriksen | Joseph | Madden | Porter | Rhone | Armstrong | Total |

|---|---|---|---|---|---|---|---|---|

| CEO / Executive Management Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 out of 7 | |

| Real Estate Industry Experience | ✓ | ✓ | ✓ | ✓ | ✓ | 5 out of 7 | ||

| Other Public Company Board Experience | ✓ | ✓ | ✓ | 3 out of 7 | ||||

| Risk Management / Strategic Planning Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 7 out of 7 |

| Public and Private Investment Experience | ✓ | ✓ | ✓ | ✓ | 4 out of 7 | |||

| Banking / Finance Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 out of 7 | |

| Accounting and Financial Reporting Experience | ✓ | ✓ | ✓ | ✓ | ✓ | ✓ | 6 out of 7 | |

| Background as of December 15, 2022 | Average | |||||||

| Tenure (Years) | 1 | 1 | 7 | 30 | 10 | 1 | 24 | 10.6 |

| Age (Years) | 62 | 48 | 61 | 73 | 71 | 52 | 58 | 60.7 |

Independence and Leadership Structure

Our Board has primary responsibility for overseeing the management of our business and affairs. Our Board consists of seven members, six of whom have been determined by our Board to be independent. Our three standing Board committees (audit, compensation, and nominating and corporate governance) are composed entirely of independent directors, and have the power and authority to engage legal, financial and other advisors as they may deem necessary, without consulting or obtaining the approval of the full Board or management. William H. Armstrong III, the chairman of our Board, is not considered an independent director because he is also our president and chief executive officer and receives compensation for his services to the Company as a member of our management team. Charles W. Porter is nominated to our Board pursuant to an Investor Rights Agreement with our stockholder LCHM Holdings, LLC. Our Board believes that the independent directors provide effective oversight of management.

Our Board believes that Mr. Armstrong's service as both chairman of our Board and as president and chief executive officer is in the best interest of the Company and our stockholders at this time. Our Board recognizes the importance of having a strong independent board leadership structure to ensure accountability and to facilitate the effective performance of the Board in its role of providing effective oversight of management. In 2013, our Board established the position of lead independent director. The role of our lead independent director is described in our corporate governance guidelines. Michael D. Madden served as our lead independent director from 2013 until April 1, 2022. Effective April 1, 2022, James E. Joseph was appointed to serve a three-year term as lead independent director.Board and Board Committee Refreshment; Annual Board Evaluation Process

Three new diverse independent directors have joined our seven-member Board in the last two years: Neville L. Rhone, Jr., Kate B. Henriksen and Laurie L. Dotter. In addition, during 2021 we refreshed the composition of our three standing committees and rotated all chair positions. Neville L. Rhone, Jr., a member of the audit committee, became chair; James E. Joseph, a member of the compensation committee, became chair; and Kate B. Henriksen, a member of the nominating and corporate governance committee, became chair. We also decreased the size of the committees to promote efficiencies and better align with peer company practices. We believe our commitment to a strong Board and corporate governance is facilitated by our annual performance evaluation of our Board and Board committees, which is overseen by our nominating and corporate governance committee. For more information on our Board committees, see our website under the heading Investors - Corporate Governance.

Board's Role in Oversight of Risk Management

Our Board of Directors as a whole is responsible for risk oversight, with reviews of certain areas being conducted by the relevant Board committees that report to the full Board. The chart below provides an overview of the areas overseen by each committee.

|

Board of Directors Responsible for risk oversight at the Company |

||||

|

||||

|

Board Committees Assist the Board in fulfilling its oversight responsibilities with respect to certain areas of risk Each committee regularly reports on these matters to the full Board |

||||

Audit Committee

|

||||

Compensation Committee

|

||||

Nominating and Corporate Governance Committee

|

||||

In its risk oversight role, our Board reviews, evaluates and discusses with appropriate members of management whether the risk management processes designed and implemented by management are adequate in identifying, assessing, managing and mitigating material risks facing the Company, including financial and operational risks. Our Board believes that full and open communication between senior management and our Board is essential to effective risk oversight. Our lead independent director regularly meets with our chairman, president and chief executive officer to discuss a variety of matters, including business strategies, opportunities, key challenges and risks facing the Company, as well as management's risk mitigation strategies. Senior management attends all regularly scheduled Board meetings where they make presentations to our Board on various strategic matters involving our operations and are available to address any questions or concerns raised by our Board on risk management or any other matters. Our Board oversees the strategic direction of the Company, and in doing so considers the potential rewards and risks of the Company's business opportunities and challenges and monitors the development and management of risks that impact our strategic goals.

Corporate Governance Guidelines; Ethics and Business Conduct Policy; Proxy Statement

Our corporate governance guidelines, along with our Certificate of Incorporation, as amended (our “Charter”), our amended and restated by-laws (our “By-Laws”) and the charters of the standing committees of our Board, provide the framework for the governance of the Company and reflect the Board's commitment to monitor the effectiveness of policy and decision making at both the Board and management levels. Our Charter, By-Laws, committee charters and corporate governance guidelines are available on our website under Investors-Corporate Governance. In addition, our ethics and business conduct policy is available on our website under Investors-Ethics and Business Conduct. Amendments to or waivers of our ethics and business conduct policy granted to any of our directors or executive officers will be published promptly on our website.

Additional information regarding our corporate governance practices can be found in our proxy statement for our most recent annual meeting of stockholders, filed with the U.S. Securities and Exchange Commission and available on our website under Investors - SEC Filings.